how to lower property taxes in georgia

Look at Your Annual Notice of Assessment. Counties where we reduce property taxes include Gwinnett County Fulton DeKalb Forsyth Fayette Hall.

Review your annual assessment.

. A homestead exemption can give you tax breaks on what you pay in property taxes. Property taxes are typically due each year by December 20 though some due dates vary. Your local tax collectors office sends you your property tax bill which is based on this assessment.

DRIVES will be unavailable on Saturday September 17 2022 from 130 pm until 1030 pm for scheduled maintenance. Counties where we reduce property taxes include Gwinnett County Fulton DeKalb Forsyth Fayette Hall. Verify the property tax record data on your home.

When people get their annual notice of assessment in the mail thats when they typically get fired up about lowering their property taxes. If the ownership of the property changes the. Limit Home Improvement Projects.

Local state and federal government websites often end in gov. Exemptions such as a homestead exemption reduce the taxable value of your property. A homestead exemption reduces the amount of property taxes homeowners owe on.

To lower your property taxes you can try some of these methods. One way is to appeal your property tax assessment. The statewide exemption is.

State of Georgia government websites and email systems use georgiagov or gagov at the end of the address. Look for possible inaccuracies on your tax bill. First understand that all property in Georgia ie land improvements and personal property is subject to being taxed unless it qualifies for a specific exemption under state law.

Research Neighboring Home Values. We lower the property tax burden for parcels all across Georgia and the Atlanta area. DRIVES System Maintenance - Saturday 917.

In order to come up with your tax bill your tax office multiplies the tax rate by. Be there when the. How can I lower my property taxes in Georgia.

DRIVES e-Services kiosk tag. Every Georgia resident whose home is owner-occupied as a primary residence may receive 2000 as a tax exemption from county and school taxes. We lower the property tax burden for parcels all across Georgia and the Atlanta area.

Dont renovate your house right before it gets assessed. If you think your property. How To Lower Property Taxes.

There are also a number of property tax exemptions in Georgia that can reduce your homes assessed value and therefore your taxes. These vary by county. How can I lower my property taxes.

The assessed value of any property can increase by no more than 2 percent per year. Plus since there are several ways your appeal can get thrown out and lots of heady math involved a tax attorney can help you figure out whether you have a caseand help. See If You Qualify For Tax.

How To Lower Property Taxes In Georgia. Apply for Homestead exemptions. Lets say this homeowner has a standard homestead exemption of 2000.

How much can property taxes increase per year in Georgia. Property taxes are paid annually in the county where the property is located. There are a few ways to lower property taxes in Georgia.

How To Lower Your Commercial Property Taxes In Cobb County

:max_bytes(150000):strip_icc()/howhomevalueisassessed-f1f98b53f65943d8bda8304d43175cfa.png)

Learn How Property Taxes Are Calculated

Tangible Personal Property State Tangible Personal Property Taxes

How To Lower Property Taxes 7 Tips Quicken Loans

Property Taxes Are Going Up What Homeowners Can Do About It

Property Taxes Laurens County Ga

Are There Any States With No Property Tax In 2022 Free Investor Guide

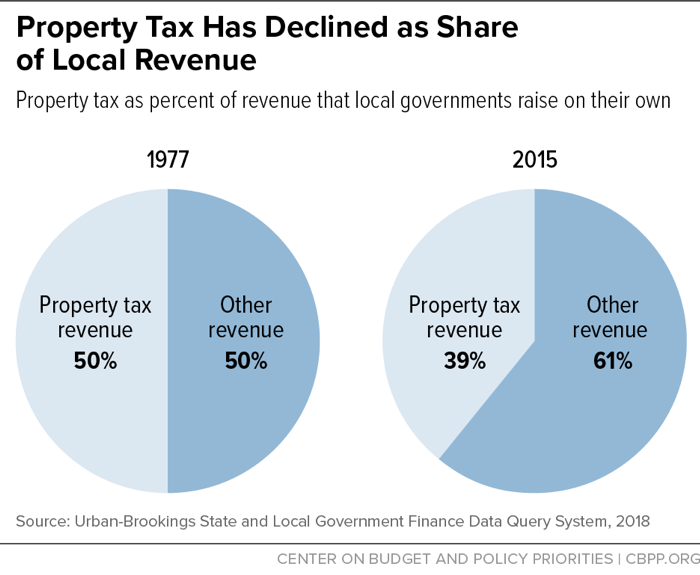

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

-resized-600.jpg)

Get Lower Property Taxes In Georgia

Here S How To Appeal Georgia S Property Tax Assessments

2022 Property Taxes By State Report Propertyshark

Georgia Property Tax Relief Inc We Reduce Your Georgia Property Taxes

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Appealing Georgia S Property Tax Assessments Youtube

Exemptions To Property Taxes Pickens County Georgia Government

Equitax Georgia Property Tax Appeal Services Tax Liability Reduction

Property Taxes By State County Lowest Property Taxes In The Us Mapped